Not known Details About Transaction Advisory Services

Wiki Article

Some Known Facts About Transaction Advisory Services.

Table of ContentsThe Definitive Guide to Transaction Advisory ServicesGetting My Transaction Advisory Services To WorkNot known Details About Transaction Advisory Services Transaction Advisory Services Can Be Fun For Anyone10 Easy Facts About Transaction Advisory Services Shown

This step makes sure the organization looks its finest to prospective buyers. Obtaining the company's worth right is essential for a successful sale.Deal experts action in to help by getting all the needed information organized, addressing inquiries from buyers, and setting up sees to business's place. This develops trust fund with customers and keeps the sale relocating along. Obtaining the very best terms is crucial. Deal experts use their knowledge to help company owner handle challenging settlements, meet purchaser assumptions, and framework bargains that match the proprietor's objectives.

Satisfying legal rules is critical in any kind of company sale. They assist company proprietors in planning for their next steps, whether it's retired life, starting a brand-new endeavor, or handling their newly found wealth.

Transaction consultants bring a riches of experience and knowledge, making certain that every facet of the sale is taken care of skillfully. Through tactical prep work, valuation, and arrangement, TAS aids company owner accomplish the highest possible sale cost. By guaranteeing lawful and regulative conformity and managing due persistance along with various other bargain employee, deal experts reduce prospective dangers and obligations.

The Main Principles Of Transaction Advisory Services

By contrast, Huge 4 TS teams: Deal with (e.g., when a potential purchaser is performing due diligence, or when an offer is closing and the customer needs to incorporate the firm and re-value the seller's Annual report). Are with charges that are not linked to the offer shutting efficiently. Make costs per engagement somewhere in the, which is much less than what financial investment banks make even on "little deals" (but the collection chance is additionally much higher).

, but they'll focus much more on accounting and appraisal and less on subjects like LBO modeling., and "accounting professional only" topics like test equilibriums and just how to walk through occasions making use of debits and credit scores instead than financial statement adjustments.

Not known Incorrect Statements About Transaction Advisory Services

Experts in the TS/ FDD teams may likewise speak with management regarding whatever above, and they'll compose an in-depth record with their searchings for at the end of the procedure.The hierarchy in Deal Providers varies a bit from the ones in investment banking and personal equity professions, and the basic shape appears like this: The entry-level duty, where you do a great deal of data and economic evaluation (2 years for a promotion from below). The next level up; similar work, yet you get the even more interesting bits (3 years for a promo).

In particular, it's tough to obtain promoted past the Supervisor level because few individuals leave the job at that stage, and you need to begin revealing proof of your capability to produce revenue to advance. Let's begin with the hours and lifestyle given that those are much easier to explain:. There are occasional late evenings and weekend job, yet absolutely nothing like the agitated nature of financial investment financial.

There are cost-of-living modifications, so expect lower payment if you're in a more affordable area outside significant monetary (Transaction Advisory Services). For all positions other than Partner, the base salary comprises the bulk of the total compensation; the year-end reward might be a max of 30% of your base pay. Commonly, the very best way to increase i was reading this your revenues is to switch over to a different company and bargain for a higher income and reward

Little Known Questions About Transaction Advisory Services.

At this phase, you need to simply stay and make a run for a Partner-level function. If you desire to leave, possibly relocate to a customer and perform their appraisals and due persistance in-house.The primary trouble is that because: You normally require to sign up with one more Big 4 group, such as audit, and work there for a couple of years and afterwards relocate into TS, job there for a few years and after that move right into IB. And visit the site there's still no guarantee of winning this IB role due to the fact that it depends upon your region, clients, and the employing market at the time.

Longer-term, there is additionally some risk of and since assessing a company's historical economic information is not specifically rocket science. Yes, humans will constantly need to be entailed, however with advanced technology, lower headcounts could possibly support customer involvements. That stated, the Deal Providers group defeats audit in regards to pay, work, and exit possibilities.

If you liked this short article, you may be thinking about analysis.

How Transaction Advisory Services can Save You Time, Stress, and Money.

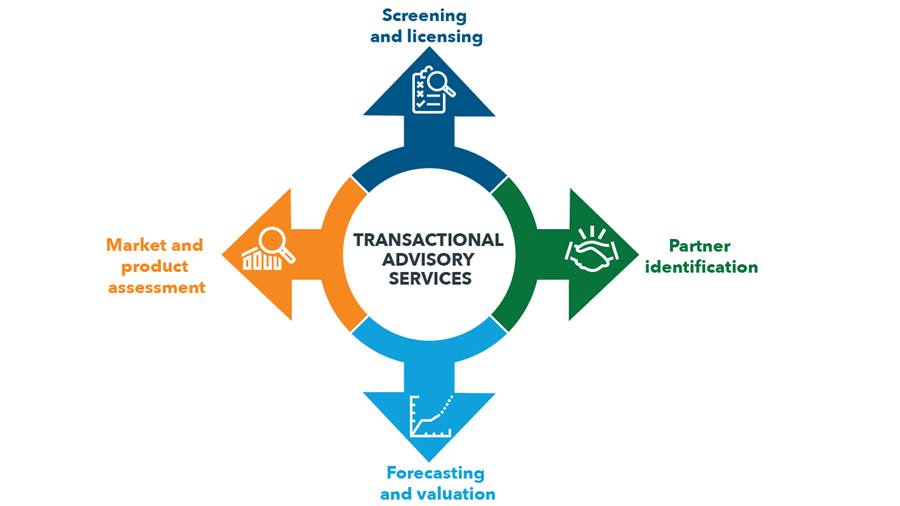

Establish innovative financial structures that help in determining the actual market price of a firm. Supply consultatory operate in relationship to organization evaluation to aid in negotiating and prices structures. Explain the most appropriate type of the bargain and the kind of factor to consider to employ (money, supply, make out, and others).

Execute integration planning to establish the process, system, and business adjustments that may be needed after the bargain. Establish standards for integrating divisions, innovations, and company procedures.

Determine potential decreases by decreasing DPO, DIO, and DSO. Evaluate the possible consumer base, market verticals, and sales cycle. Think about the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The functional due persistance provides important understandings into the performance of the firm to be gotten worrying danger analysis and value development. Recognize short-term alterations to funds, financial institutions, and systems.

Report this wiki page